Follow Daryo’s official Instagram and Twitter pages to keep current on world news.

The financial technology (fintech) sector in Uzbekistan is poised for exponential growth, with projections indicating a doubling of cash payments and transfers by 2027. A study conducted by KPMG Caucasus and Central Asia revealed significant advancements in non-cash payments, underlining the country’s evolving fintech landscape.

In 2022, non-cash payments and transfers accounted for approximately 58% of Uzbekistan’s GDP, marking a substantial increase from previous years. The consumer retail lending market experienced a remarkable 66% cumulative annual growth from 2020 to 2023.

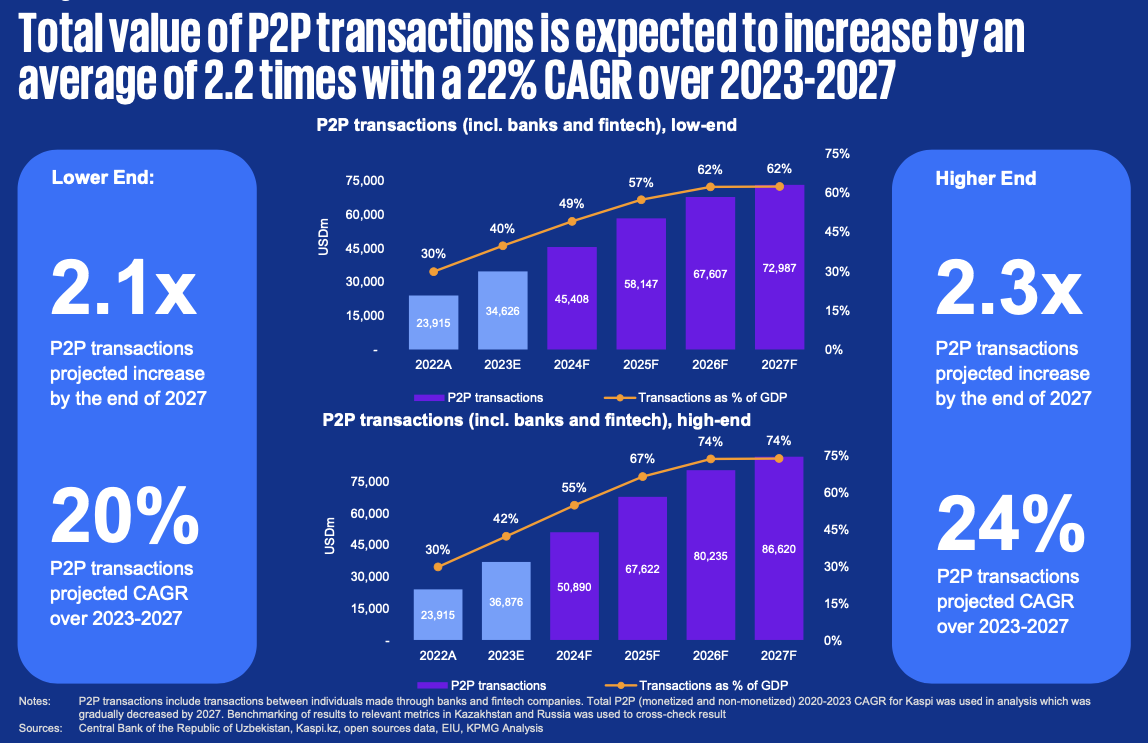

average of 2.2 times with a 22% CAGR over 2023-2027

The turnover of non-cash transactions, including payments and money transfers facilitated by banks and payment organizations, amounted to $36.2 bn and $10.5 bn, respectively, in 2022. Projections suggest that by 2027, the total volume of non-cash transactions could range from $107 bn to $125 bn.

Farrukh Abdullakhanov, a partner at KPMG Caucasus and Central Asia, explained the digitalization of various sectors as a priority for Uzbekistan’s development until 2030. The burgeoning fintech sector has attracted considerable attention from both domestic and foreign investors, with a trend of market consolidation expected to continue in 2024 following the implementation of updated regulations for payment organizations.

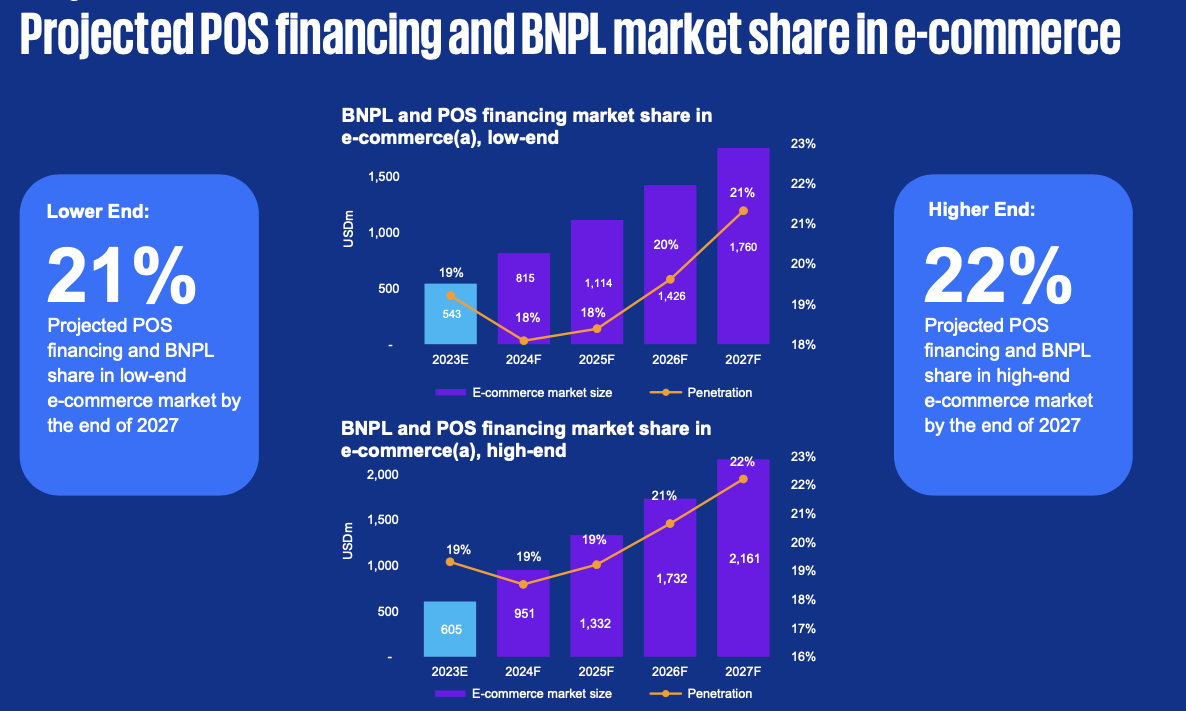

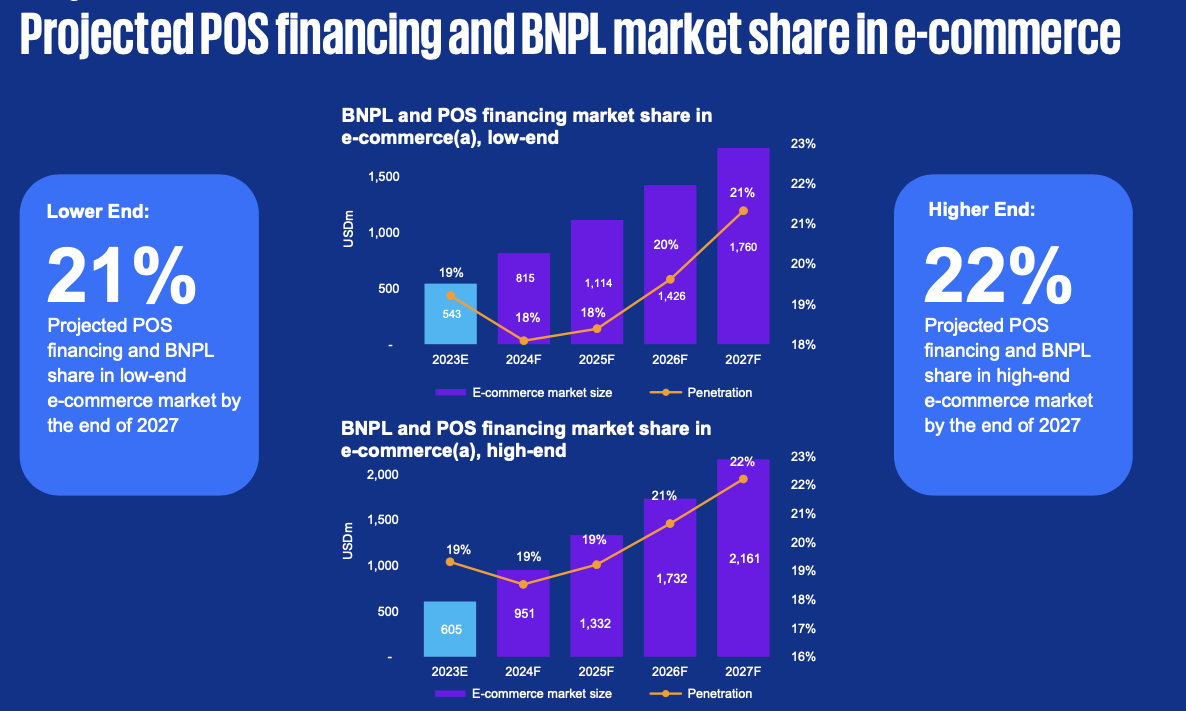

The study also examined the point-of-sale (POS) financing and installment financing markets, estimating a combined turnover (GMV) of $450 mn to $500 mn. By 2027, the POS financing and Buy Now, Pay Later (BNPL) market is predicted to reach a turnover ranging from $1.5 bn to $2 bn, with an annual cumulative growth rate of 38% to 42%.

Vitaly Yakovlev, another partner at KPMG Caucasus and Central Asia, highlighted the increasing adoption of online installment services, particularly within the e-commerce segment.

“In the POS financing and installment plan market, more aggressive growth is expected in the online e-commerce segment, although historically installment payments are more popular and developed in the offline segment. We see that with the growth of e-commerce, consumers show more confidence in online installment services. In turn, market participants use their own scoring models based on machine learning, which makes it possible to reduce the decision-making process on providing financing to 1 minute based on electronic data of the population available on government portals. ,” Vitaly Yakovlev says.

The study further noted a surge in investor interest in Uzbekistan’s fintech market in recent years, underscoring the sector’s potential for robust growth and innovation in the years ahead.